Welcome To Coinshell

India’s Focused Platform for

Startups in Formation for Funding

Get your virtual Accounts & Finance Team from today

Package include

- Private Limited Company

- Registration package

- Business loan assistance

- Startup funding assistance

Unlock Your Business Potential with Our

Private Limited Company Registration Package!

Limited Time Offer:

Navigating Success Through Our Partners

Solution For Every Business Needs

Need a personalized solution?

Share your details and our team will reach your will best solutions for your business needs

Our Values

Your Expedition, Our Expertise

Coinshell works on providing the right solutions to Startups and MSME’s for their junction in business journey.

We understand the amount of hardwork and dedication by the entrepreneur. So we not just facilitate the business commencement but also stay along in growing their business with our B2B network and credit facility networks.

Save Time & Money

Get fast service with experts

Consult and Learn

24/7 Chat Support

100 % Confidential

Your information is safe

Funding & More

Raise funds easily

Empowering Businesses

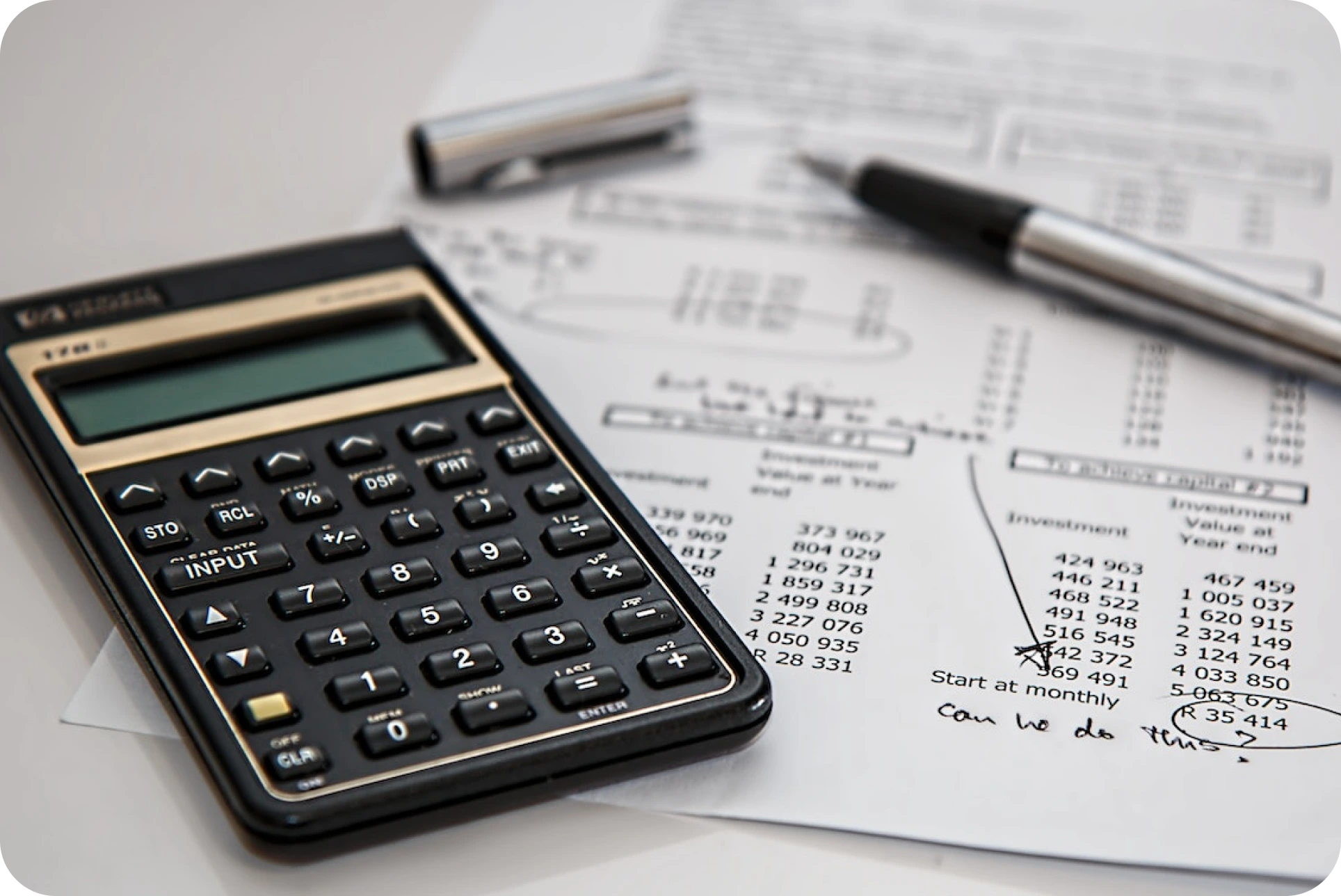

Empowering You To Make

Sound Financial Decisions

Stop worrying about your finance and accounts and Start focusing on business growth

Virtual accounting service PAN India

Finance/Taxation /Compliances

Raising funds for the business

No matter who you are, we’ve got what you need.

Serving PAN India

Over 300 startups every month

In House Investor Connect

Network for Angel / VC funding

Offering 200+ Business Growth Services

With experienced entrepreneurs and professionals

We Are Growing with

Our Blogs

Bridging Knowledge And Success

GST registration and its features

What is composition scheme in GST?

What is E-invoicing in GST?

Get a free Consultation

Coinshell delivers the fast assistance over your Business, Accounting , Taxation and Fundraising Needs

Thousands of Startups trust on Coinshell’s theme of Formation to Funding which not only help them start a business but also to raise funds at right time to scale the business