GST Services

GST for Business

GST Registration: Your Pathway to Seamless Business Operations

Benefits of GST Return Filing

GST eliminates cascading effect

Earlier there were many instances where tax on tax was paid for a single transaction. As GST did away with several other taxes like central excise duty, service tax, customs duty, and state-level value-added tax, you no longer are subjected to paying tax on tax. This saves you money.

Higher threshold

The threshold for GST is aggregate turnover exceeding 40 lakhs for sale of goods and aggregate turnover exceeding 20 lakhs for sale of services. This means small businesses falling below this threshold limit are not subject to GST.

Easier for startups and e-commerce businesses

The GST system has made it easier for startups and e-commerce companies to manage their taxes. E-commerce particularly suffered from different tax laws across different states which are now eradicated by GST.

More organised system

Before GST the tax filing system was disorganised. Now, all taxes are paid online and major hassles that were a part of tax filing have been eliminated in the process of introducing GST.

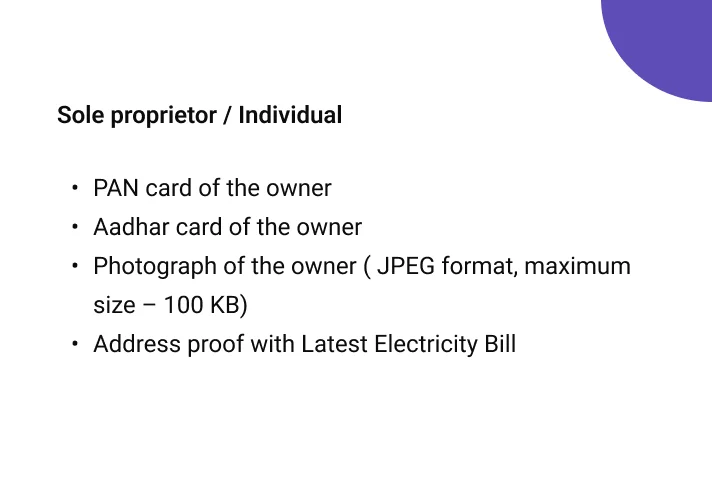

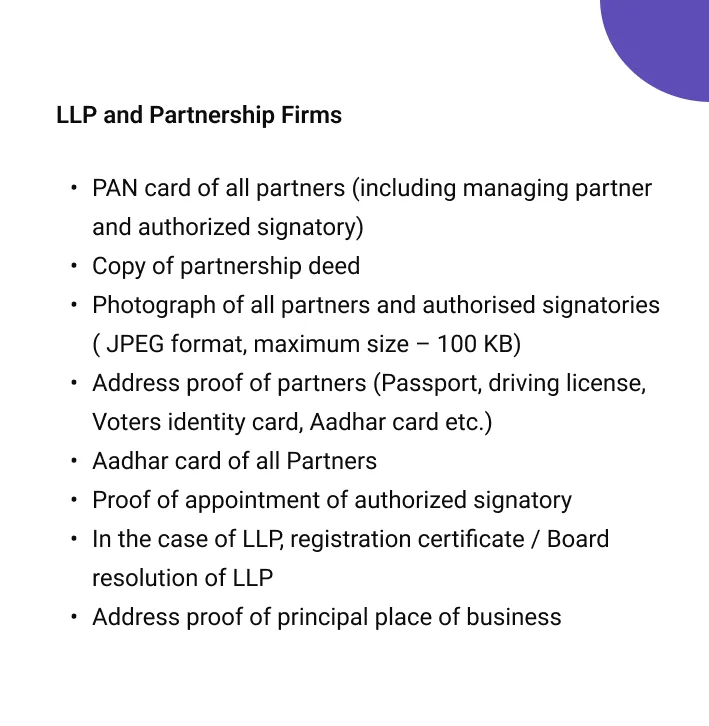

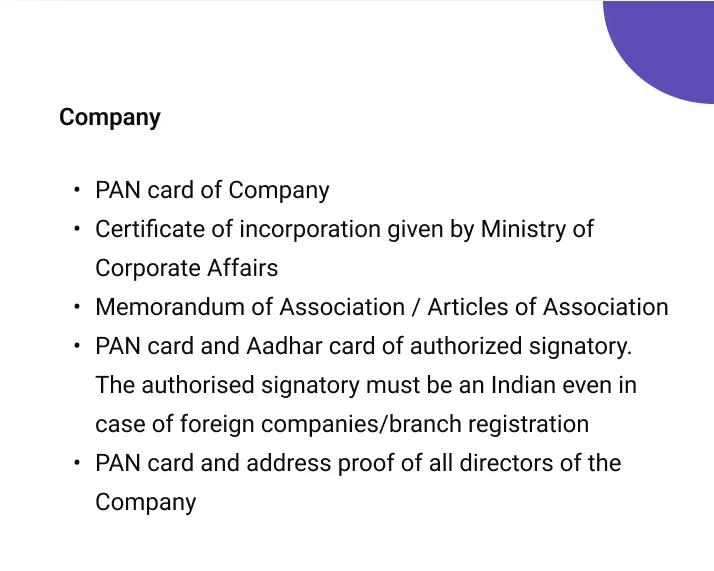

Documents Required

Pricing and Plans

Rs.999/-

Basic

2. GST Filing for 3 months

3. Free training on GST

4. Sale Purchase record sheet

Rs.5999/-

Premium

2. Free training on GST

3. Sales / Purchase record sheet

4. Sales / Purchase record sheet

Unlock Personalized Business Solutions.

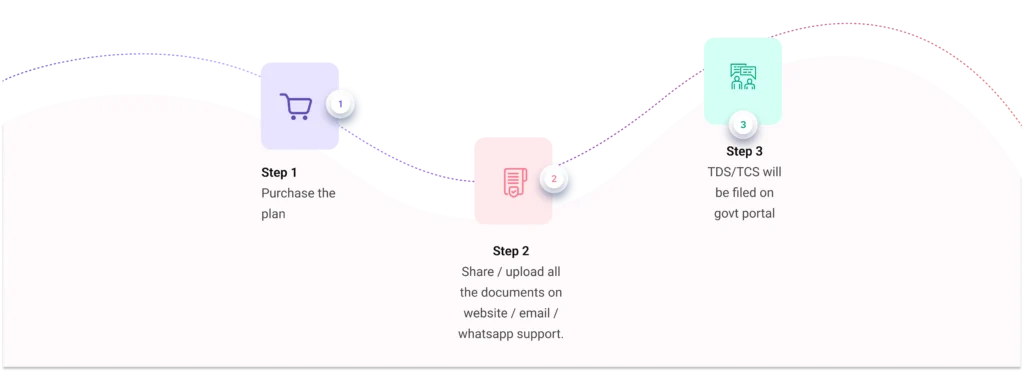

Our Process

Our Seamless Process for Tailored Solutions

FAQ

Frequently Asked Questions