Company Compliances

Home > Compliances > Company Compliances

Annual Compliance for PLC /OPC/LLP

Why Annual Compliance ?

1. To submit the performance reports of business in government records.

2. To build financial credibility for becoming eligible for equity or debt funding.

3. To audit and acknowledge business stats for tax benefits.

2. To build financial credibility for becoming eligible for equity or debt funding.

3. To audit and acknowledge business stats for tax benefits.

Annual Compliance for Company

Simplifying your business requirements isn’t just our job, but our ethos. A well-maintained accounting and compliance system can help your company cut accounting costs and track its financial progress.

Importance of Accounting & Business Compliances to a Business

1. Budgeting: It assists organizations in efficiently controlling the company’s income and expenditure while monitoring managerial policies and goals.

2. Evaluating the Business’s Performance: Helps in measuring the performance of the business in terms of key measures such as net profit, sales growth, and so on.

3. Managing Cash Flow: Keeping track of the money that comes into the business on a regular basis helps in projecting patterns, paying employees and suppliers, repaying debts, etc.

4. Financial Information to Investors and Stakeholders: Investors will gain a better understanding of the business’s financial health, including its solvency, creditworthiness, liquidity, stock, and bond issuers.

5. Mandatory by law: In India, the Registrar of Companies requires a strict record of income tax payments at the end of the year, failing which companies may face additional taxes or fines.

2. Evaluating the Business’s Performance: Helps in measuring the performance of the business in terms of key measures such as net profit, sales growth, and so on.

3. Managing Cash Flow: Keeping track of the money that comes into the business on a regular basis helps in projecting patterns, paying employees and suppliers, repaying debts, etc.

4. Financial Information to Investors and Stakeholders: Investors will gain a better understanding of the business’s financial health, including its solvency, creditworthiness, liquidity, stock, and bond issuers.

5. Mandatory by law: In India, the Registrar of Companies requires a strict record of income tax payments at the end of the year, failing which companies may face additional taxes or fines.

Pricing Plans

Basic

Rs. 6999/-

GST Filing for 1 year

Filing for MGT-7

Filing of AOC-4

Filing of DPT-3 ( if applicable)

Filing of ADT-1

DIR-3 KYC

Government Fees Included

Filing for MGT-7

Filing of AOC-4

Filing of DPT-3 ( if applicable)

Filing of ADT-1

DIR-3 KYC

Government Fees Included

Premium

Rs. 19999/-

Preparation of Balance sheet

Preparation of P&L

Preparation of Books of Accounts

Preparation of Director Report

Board Resolutions / AGM

Filing of AOC-4 / MGT-7/ADT-1/DPT-3

ITR filing of Company

ITR filing of Directors

Dir 3-KYC

GST Filing for 1 year

All quarterly / annual compliances

Government Fees Included

Preparation of P&L

Preparation of Books of Accounts

Preparation of Director Report

Board Resolutions / AGM

Filing of AOC-4 / MGT-7/ADT-1/DPT-3

ITR filing of Company

ITR filing of Directors

Dir 3-KYC

GST Filing for 1 year

All quarterly / annual compliances

Government Fees Included

*Valid upto turnover of Rs 50lacs

Need Personalized Solution

Share your details and our team will reach your will best solutions for your business needs .

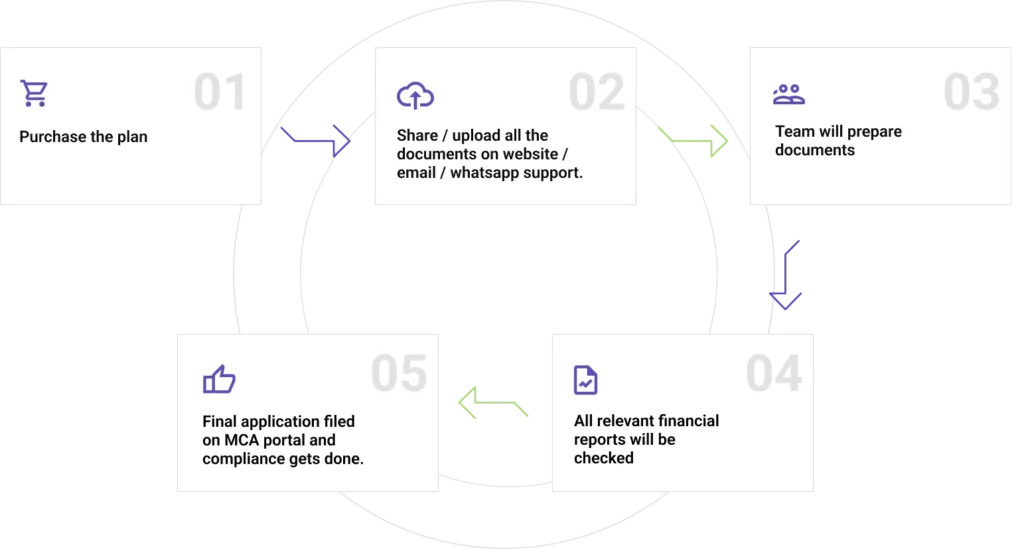

Our Process

Know How Coinshell Work

FAQ

Have any Questions?

Better accounting provides numerous benefits, including accurate financial insights for informed decision-making, regulatory compliance, enhanced credibility with stakeholders, efficient tax planning, optimized resource allocation, and a stronger foundation for growth.

While maintaining books on your premises is possible, you can also appoint a professional accounting service like Coinshell to handle your accounting needs. Outsourcing can bring efficiency, accuracy, and expert insights to your financial management.

Yes, Coinshell can provide you with suitable accounting software tailored to your company’s needs. This software can streamline your financial record-keeping and reporting processes.

Companies are required to file the Annual Return (Form MGT-7) and Financial Statements (Form AOC-4) with the Registrar of Companies (RoC) every year as part of their annual compliance.

The annual general meeting (AGM) should be held at the registered office of the company or within the city where the registered office is located. It should be conducted within six months from the end of the financial year.

Correct, Form ADT-1 is filed with the RoC to intimate the appointment or reappointment of the company’s Statutory Auditor. This form needs to be filed within 15 days of the auditor’s appointment.

Your financial data’s security is a priority. Coinshell employs robust security measures to protect your data against unauthorized access or breaches, ensuring confidentiality and compliance with data protection regulations.

Yes, the appointment or reappointment of the Statutory Auditor, along with filing Form ADT-1, falls under the umbrella of annual compliance activities.

The annual return (Form MGT-7) should be filed within 60 days from the date of the AGM

Yes, for Private Limited Companies, audited financial statements are mandatory to be submitted along with the annual filing. These statements include the Balance Sheet, Profit and Loss Account, Cash Flow Statement, and Notes to Accounts.

Get a free Consultation

Coinshell delivers the fast assistance over your Business, Accounting , Taxation and Fundraising Needs

Thousands of Startups trust on Coinshell’s theme of Formation to Funding which not only help them start a business but also to raise funds at right time to scale the business