Foreign funding is essential for many Indian NGOs, enabling them to scale their impact across education, healthcare, social welfare, and environmental initiatives. However, receiving foreign donations is not as simple as setting up a bank account and accepting funds. The Foreign Contribution (Regulation) Act (FCRA), 2010, regulates how NGOs can receive and utilize foreign contributions.

Without FCRA approval, NGOs cannot legally receive foreign donations, and any non-compliance can result in penalties, frozen bank accounts, or cancellation of registration.

Understanding the Importance of FCRA Compliance

- The Ministry of Home Affairs (MHA) governs FCRA compliance in India to prevent the misuse of foreign funds.

- As of 2023, over 20,000 NGOs lost their FCRA licenses due to non-compliance with annual reporting requirements.

- Since 2021, all foreign contributions must be received through an SBI FCRA account in New Delhi to enhance transparency.

- NGOs failing to submit annual FCRA returns (FC-4) may face severe financial and operational restrictions.

An NGO must obtain FCRA registration if:

- It receives foreign donations from individuals, organizations, or institutions.

- It operates in sectors such as education, healthcare, social work, human rights, or religious activities and relies on foreign funding.

- It plans to collaborate with international organizations and accept financial aid.

Who Cannot Receive Foreign Contributions?

- Political parties and candidates

- Government officials, judges, or members of any legislature

- Journalists and media organizations

- Any organization working against India’s national interest

Even NGOs engaged in welfare activities must follow strict FCRA rules to avoid compliance violations.

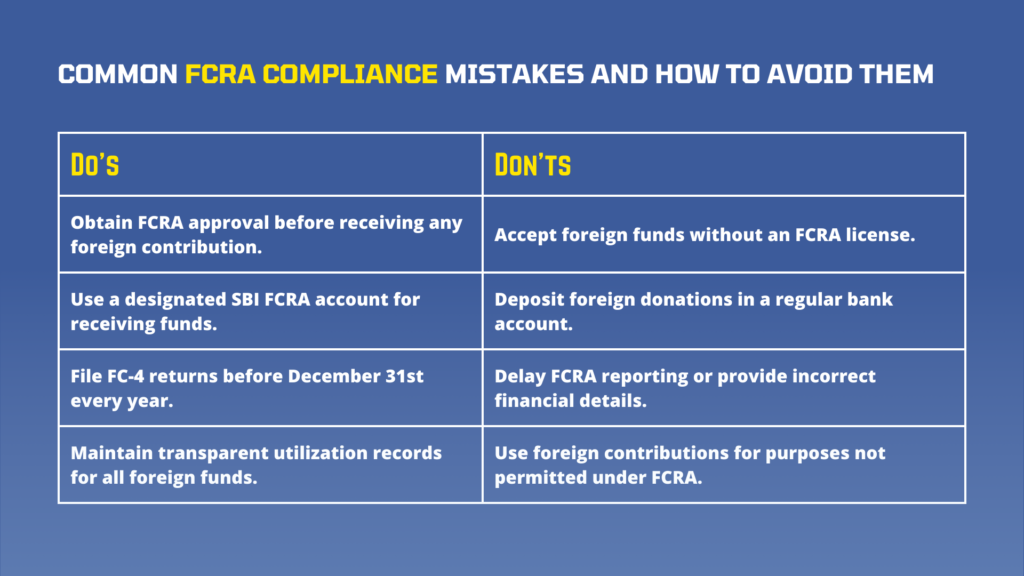

Steps to Obtain and Maintain FCRA Compliance:

1. Apply for FCRA Registration or Prior Permission

There are two ways an NGO can receive foreign donations legally:

- FCRA Registration: Available to NGOs that have been in operation for at least three years and have a record of significant activities.

- Prior Permission (PP): For newly established NGOs, this allows them to receive foreign donations for a specific project from a specific donor.

2. Open a Designated FCRA Bank Account

As per the FCRA Amendment Act, 2020, all NGOs must receive foreign contributions through a State Bank of India (SBI) account in New Delhi.

Why is this required?

- Ensures greater financial transparency and regulatory tracking.

- Helps the government monitor potentially illegal transactions.

- Prevents automatic fund freezing due to FCRA violations.

3. File Annual FCRA Returns (FC-4) on Time

The FCRA annual return filing deadline is December 31st every year. NGOs must submit Form FC-4, disclosing:

- The total foreign contributions received during the financial year.

- A detailed utilization report explaining how funds were spent.

- Audited financial statements certified by a Chartered Accountant.

Failure to submit FC-4 returns can lead to:

- FCRA license cancellation and blacklisting.

- Frozen bank accounts, preventing fund access.

- Government audits and financial scrutiny.

4. Maintain Proper Financial Records

To remain compliant, NGOs must:

- Maintain separate books of accounts for foreign and domestic funds.

- Ensure funds are used only for permitted purposes.

- Retain transaction records, donor details, and expenditure reports for a minimum of five years.

Consequences of FCRA Non-Compliance: A Real-Life Case Study of an NGO Blacklisted for Non-Compliance

An NGO working in the education sector received foreign donations for building rural schools. However, it failed to submit FC-4 reports for two consecutive years.

What happened next?

- The NGO’s FCRA license was canceled, blocking its ability to receive foreign funds.

- Their foreign bank accounts were frozen, preventing salary payments and operational costs.

- The NGO was blacklisted from receiving future international grants.

Hence, an NGOs must stay compliant and submit timely reports to ensure continued access to foreign funding.

How Coinshell Can Help NGOs with FCRA Compliance?

FCRA laws are complex, but our team at Coinshell makes compliance easy. Our FCRA Compliance Services Include:

- End-to-End FCRA Registration: Hassle-free approval for NGOs.

- Annual Return Filing (FC-4): Timely submission to prevent penalties.

- Foreign Fund Audits & Documentation: Ensuring complete transparency.

- Legal Advisory & Risk Management: Protecting NGOs from non-compliance issues.

Secure Your NGO’s Future with Compliance:

NGOs play a crucial role in social development, but without FCRA compliance, their operations are at risk. Following the right processes can help your organization:

- Maintain its credibility among donors and authorities.

- Avoid financial and legal penalties.

- Continue receiving foreign grants smoothly.

Take Action Now and let Coinshell Handle Your FCRA Compliance

Get in touch with us today for expert FCRA guidance and compliance support!