Starting a business is exciting, but funding decisions can make or break a startup. Should you bootstrap and retain complete control, or should you raise venture capital (VC) and scale rapidly?

But here’s the real question: Are you aware of the legal and compliance challenges that come with each choice? Many startups focus only on money, forgetting the legal headaches, investor obligations, and tax burdens that follow.

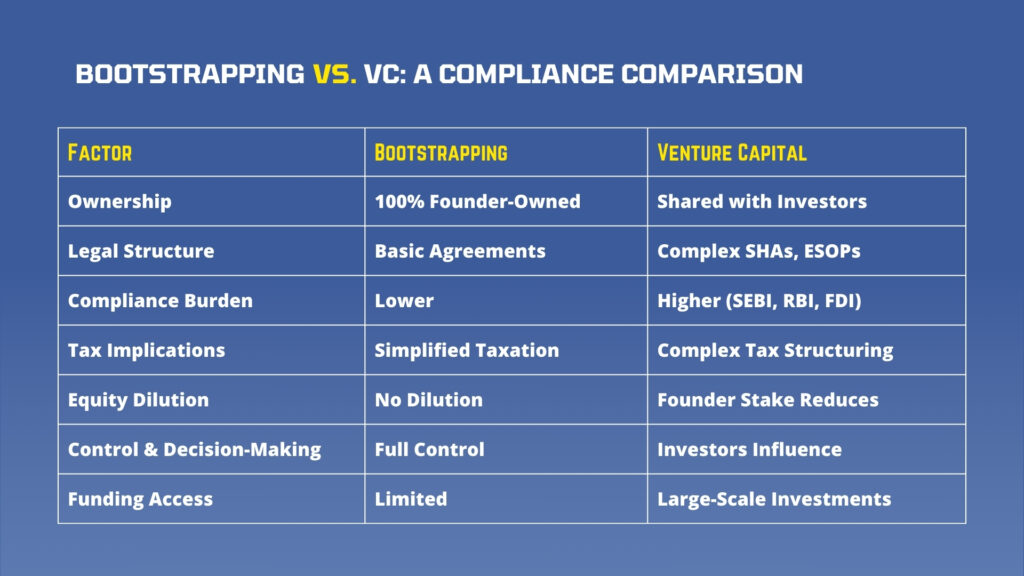

Before making your decision, let’s decode the compliance side of startup funding.

Why Does This Debate Matters?

Every founder wants to scale fast, but not everyone understands the compliance risks that come with funding decisions.

- India is the third-largest startup ecosystem, with over 1 lakh startups registered under DPIIT.

- Over 90% of startups fail due to financial & compliance mismanagement, not just lack of funding.

- Many bootstrapped startups struggle with tax efficiency, while VC-backed startups get tangled in complex legal structures.

So, how do you protect your startup from financial, legal, and compliance pitfalls? Let’s find out.

Bootstrapping: A Self-Sustained Journey with Hidden Risks

Bootstrapping means self-funding your startup, either through personal savings, revenue reinvestment, or small loans without external investors.

Successful bootstrapped startups include Zerodha, Zoho, Physics Wallah, and Noise.

- Advantages of Bootstrapping:

- 100% Ownership & Control – No investors dictating your decisions.

- No Equity Dilution – You own all future profits.

- Flexibility & Freedom – No pressure for fast exits or IPOs.

- Legal & Compliance Challenges:

- Unstructured Ownership: Many bootstrapped startups operate informally without proper founder agreements, equity structuring, or tax planning, leading to disputes later.

- Tax Inefficiencies: Founders often mix personal and business finances, leading to GST issues and tax penalties.

- Regulatory Non-Compliance: With no investors enforcing legal oversight, startups tend to ignore mandatory filings, putting them at risk of government scrutiny.

- How to Stay Compliant While Bootstrapping?

- Register your business properly – Choose Pvt. Ltd., LLP, or Sole Proprietorship.

- Have a structured Founder Agreement – Define equity, decision-making rights, and roles.

- File annual GST, ROC, & tax filings – Avoid penalties and legal trouble.

Bootstrapping gives you freedom, but missing compliance can shut your business overnight!

Venture Capital: High Growth, But at What Cost?

VC involves raising capital from investors in exchange for equity (ownership). It is ideal for scaling fast, entering global markets, and attracting top talent.

Funded startups like Flipkart, Swiggy, and Byju’s grew exponentially with VC backing.

- Advantages of VC Funding:

- Instant Access to Large Capital – Scale fast without waiting for revenue.

- Investor Network & Mentorship – Get industry experts to guide you.

- Credibility & Market Presence – Boosts investor confidence and brand value.

- Legal & Compliance Challenges:

- Equity Dilution & Investor Control: Founders must give up ownership, reducing decision-making power.

- Strict SEBI, RBI, & FDI Regulations: Startups need investment approvals, tax structuring, and financial audits.

- Complex Term Sheets & Agreements: SHA (Shareholders’ Agreement), ESOP structuring, and Cap Table management require legal expertise.

- How to Stay Compliant When Raising VC?

- Understand equity dilution – Ensure shareholding is structured correctly.

- Follow SEBI, RBI, and FEMA regulations – Essential for foreign funding.

- Ensure financial & tax compliance – Timely filings, audits, and tax planning are critical.

VC funding brings rapid growth but demands intense regulatory and legal discipline!

How to Choose the Right Funding Model?

- Choose Bootstrapping if:

- You want full control over your business.

- You have a sustainable revenue model.

- You prefer slow and steady growth without external pressure.

- Choose Venture Capital if:

- You need high capital for rapid scaling.

- You can handle strict legal & compliance obligations.

- You don’t mind sharing equity with investors.

Before making a decision, consult legal & financial experts to ensure compliance and avoid costly mistakes!

How Coinshell Helps You Stay Legally Compliant?

Whether you’re bootstrapping or raising VC funds, compliance should never be ignored. Coinshell ensures startups stay legally strong and investor-ready!

- For Bootstrapped Startups:

- Business registration & founder agreements

- Tax planning & GST compliance

- ESOP structuring & financial management

- For VC-Backed Startups:

- Term sheet & shareholder agreements

- SEBI, RBI, and FDI compliance

- Cap table management & investor reporting

Compliance is the Key to Long-Term Success!

Funding isn’t just about raising money, it’s about understanding the legal responsibilities that come with it.

- Bootstrapping gives you freedom, but requires strong compliance discipline.

- VC funding fuels rapid growth, but demands high regulatory compliance.

Whichever path you choose, make sure your startup is legally protected.

Coinshell makes compliance easy, so you can focus on scaling your business. Contact us today & let’s build your startup the right way!