Startups are always on the lookout for innovative ways to attract, retain, and motivate top talent. Two of the most popular methods for compensating key employees and stakeholders are Employee Stock Option Plans (ESOPs) and sweat equity shares. While these terms are often used interchangeably, they serve distinct purposes and have different legal, financial, and tax implications. Understanding these differences can help founders make smarter decisions about which option to offer.

Let’s break down the essentials and explore which option might be the right fit for your startup.

What Are ESOPs?

An Employee Stock Option Plan (ESOP) allows employees to purchase shares of the company at a predetermined price after a specified period, known as the vesting period. ESOPs are designed to align the interests of employees with the long-term success of the company.

Key Features of ESOPs:

- Vesting Schedule: Employees earn the right to purchase shares over time, typically spread across 3-5 years.

- Exercise Price: The price at which employees can buy the shares is often lower than the market value, making it attractive.

- Lock-In Period: Once the shares are purchased, they may be subject to a lock-in period during which they cannot be sold.

- Exit Event: Employees can sell their shares during an exit event, such as an IPO or acquisition.

Advantages of ESOPs:

- Motivation & Retention: Employees are motivated to stay and contribute to the company’s growth.

- No Immediate Dilution: Since employees need to exercise their options, there is no immediate dilution of ownership.

Tax Implications:

- At Exercise: Employees pay tax on the difference between the exercise price and the fair market value (FMV) as perquisite income.

- At Sale: Capital gains tax is applicable on the difference between the sale price and the FMV at the time of exercise.

What is Sweat Equity?

Sweat equity shares are issued by a company to its directors or employees in recognition of their contribution in the form of know-how, intellectual property, or value addition. Unlike ESOPs, these shares are directly issued, often at a discount or for consideration other than cash.

Key Features of Sweat Equity:

- Immediate Ownership: Unlike ESOPs, recipients of sweat equity become shareholders immediately.

- Non-Cash Consideration: Sweat equity is often issued in lieu of cash compensation.

- Valuation Requirement: Issuance of sweat equity requires a fair valuation by a registered valuer.

- Dilution: Sweat equity leads to immediate dilution of ownership.

Advantages of Sweat Equity:

- Reward for Contribution: Ideal for recognizing significant non-monetary contributions.

- Immediate Stake: Recipients gain immediate ownership, fostering a sense of partnership.

Tax Implications:

- At Issuance: The difference between the FMV and the issue price is taxable as perquisite income.

- At Sale: Capital gains tax is applicable on the difference between the sale price and the FMV at the time of issuance.

Which Option Should You Choose?

When to Choose ESOPs:

- For a Large Employee Base: ESOPs work well when you want to incentivize a broad group of employees.

- For Long-Term Retention: The vesting schedule ensures employees stay committed over a period of time.

- For Cash-Conscious Startups: Since ESOPs don’t require immediate dilution or significant cash outflow, they are ideal for early-stage startups.

When to Choose Sweat Equity:

- For Key Contributors: Sweat equity is suitable for key employees, early-stage partners, or directors who have made significant non-cash contributions.

- For Immediate Recognition: When you want to immediately reward someone with ownership.

- For Specialized Talent: If you are onboarding talent that brings unique intellectual property or know-how, sweat equity can be a compelling offer.

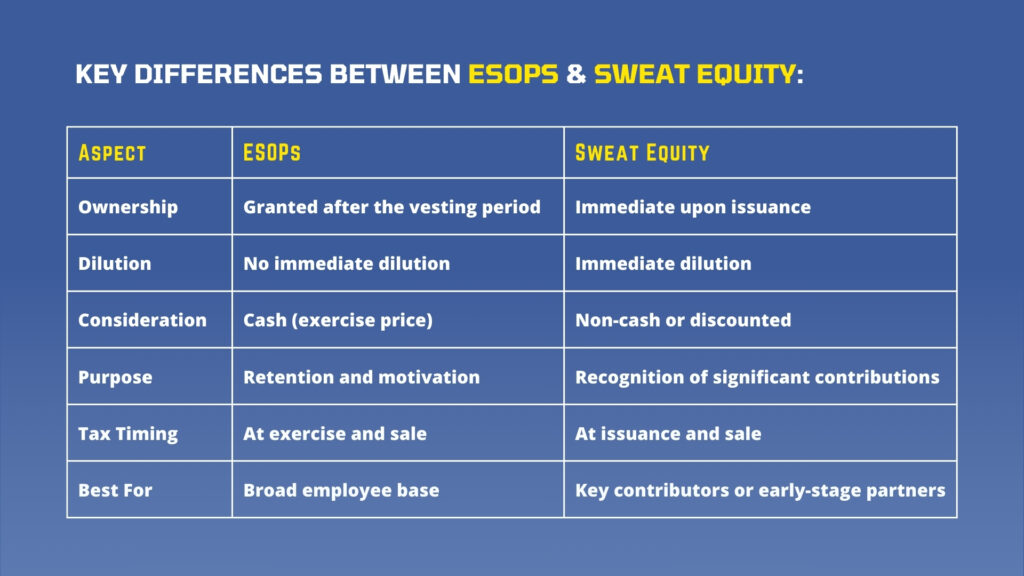

Both ESOPs and sweat equity shares are powerful tools for startups to attract and retain talent, but choosing the right option depends on your specific goals and stage of growth. ESOPs are better suited for long-term retention and broad employee engagement, while sweat equity works well for key contributors and specialized roles.

Need help setting up an ESOP plan or issuing sweat equity? Coinshell offers end-to-end support, from compliance to execution. Contact us today to get started!