Import Export Code

Home > IPR & Services > Import Export Code

Import export code for Business

Why Import Export code is needed?

1. Enables businesses to enter global market for trade.

2. Allows easy foreign remittance while trading overseas.

3. Enables easy trade facility in airport and shipyard for all types of logistic movements.

2. Allows easy foreign remittance while trading overseas.

3. Enables easy trade facility in airport and shipyard for all types of logistic movements.

Import and Export code is a 10 digit unique number issued by the Directorate General of Foreign Trade (DGFT) to a business entity for import and export in India.

The Import and Export Code helps the business grow in the global market. To clear customs, the trader must ensure that the importing entity has IE code and GST registration before initiating import of goods. If an importer does not have both IE code and GST Registration, the goods will be stuck at the port and will start incurring demurrage charges or could be destroyed.

Once issued the IE Code is valid throughout the existence of the entity and there is no need to renew the code.

The Import and Export Code helps the business grow in the global market. To clear customs, the trader must ensure that the importing entity has IE code and GST registration before initiating import of goods. If an importer does not have both IE code and GST Registration, the goods will be stuck at the port and will start incurring demurrage charges or could be destroyed.

Once issued the IE Code is valid throughout the existence of the entity and there is no need to renew the code.

Benefits

1. The IEC registration helps traders open the doors to venture into the global market, including registration in online e-commerce operators

2. Businesses can avail government schemes like the Merchandise Export from India Scheme (MEIS), the Service Export from India Scheme (SEIS), and others from customs and export promotion

3. No compliance requirements pos registration and hence maintaining the business is relatively simple

4. The process of obtaining IEC is not tedious and can be obtained with minimal, basic documents.

2. Businesses can avail government schemes like the Merchandise Export from India Scheme (MEIS), the Service Export from India Scheme (SEIS), and others from customs and export promotion

3. No compliance requirements pos registration and hence maintaining the business is relatively simple

4. The process of obtaining IEC is not tedious and can be obtained with minimal, basic documents.

Our Package Include

1. IEC certificate

2. Payment gateway setup for foreign remittance

Rs.999/-

Help us help you by sharing your details that will enable us to provide you with the best possible assistance.

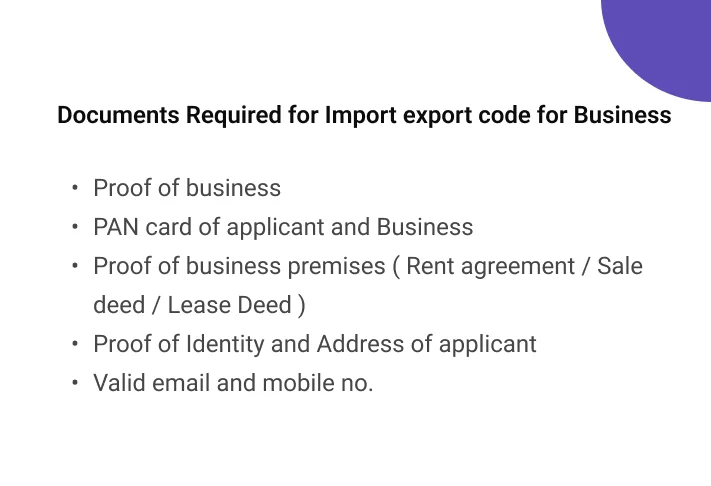

Documents Required for Trademark Registration

Need Personalized Solution ?

Please provide your contact information, and our team will get in touch to offer optimal solutions tailored to your business requirements.

Our Process

Know How Coinshell Work

Step 1

Purchase the plan

Step 2

Share/ Upload the documents

Step 3

Application will be ready in 30 minutes

Step 4

Certificate will generated and sent to the applicant.