When startups begin to scale, they often look beyond just raising funds—they explore investing in or lending money to other businesses. But did you know that such transactions fall under Section 186 of the Companies Act, 2013 and come with strict legal compliance?

According to reports, over 60% of compliance-related fines on Indian companies are due to improper financial transactions, including unstructured loans and investments. Non-compliance can lead to fines up to ₹25 lakh or worse, legal scrutiny from regulatory bodies.

So, before your startup considers investing in another company or lending money, here’s what you need to know.

What is Section 186 of the Companies Act, 2013?

Section 186 regulates the loans, investments, guarantees, and securities a company can provide to another business. It exists to prevent misuse of corporate funds and ensure financial stability.

What Does It Cover?

- Lending money to another company or individual.

- Investing in shares, securities, or bonds of another company.

- Providing corporate guarantees or collateral for another business’s loan.

In FY 2023, Indian startups raised over $15 billion in investments, yet nearly 30% of founders misunderstood corporate loan regulations, resulting in compliance errors.

How Much Can a Startup Lend or Invest?

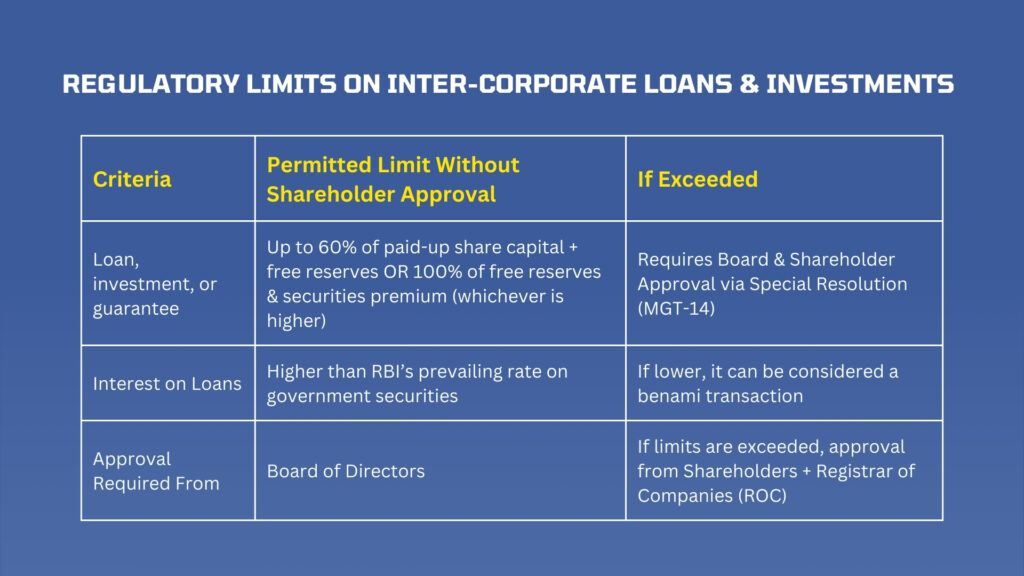

Section 186 sets specific limits on how much a company can lend or invest without requiring additional approvals.

Common Mistakes Startups Make & Their Consequences

Mistake 1: Giving Loans Without Proper Documentation

Consequence: The transaction may be classified as income diversion, attracting a 30% tax penalty.

Mistake 2: Exceeding the 60% Investment Limit Without Approval

Consequence: The company can face fines up to ₹25 lakh, and directors may be personally liable.

Mistake 3: Ignoring Interest Rate Rules

Consequence: A startup that gives an interest-free loan to its subsidiary may face income tax scrutiny and additional liabilities.

Who is Exempt from Section 186?

Not all businesses are bound by these restrictions. The following entities are exempt:

- Banks, Insurance Companies & Housing Finance Corporations – Since lending is their core business.

- NBFCs (Non-Banking Financial Companies) – If regulated by RBI guidelines.

- Government-Approved Infrastructure & Investment Companies – If notified under special schemes.

Pro Tip: If your startup is planning cross-border funding, foreign exchange laws (FEMA) and RBI approvals are also necessary.

How to Stay Compliant While Lending or Investing?

To avoid penalties and legal risks, follow these 5 essential compliance steps:

Step 1: Get Board & Shareholder Approval – If crossing the 60% limit, a special resolution (MGT-14) is required.

Step 2: Ensure RBI-Approved Interest Rates – Any loan given should not be interest-free unless exempted.

Step 3: Maintain Proper Documentation – Correctly file agreements, financial reports, and tax statements.

Step 4: Verify SEBI & RBI Compliance – If dealing with public investment or foreign capital.

Step 5: Conduct Regular Audits – Ensure financial transactions align with legal and tax regulations.

How Coinshell Helps Startups Stay Compliant?

At Coinshell, we ensure startups navigate financial regulations without stress. Whether you’re bootstrapped or VC-funded, our compliance experts help you:

- Structure inter-corporate loans & investments legally

- Get board & shareholder approvals seamlessly

- File ROC documentation & SEBI compliance

- Prevent tax penalties & financial mismanagement

Don’t let compliance errors cost you lakhs!

Contact us today or visit www.coinshell.in for expert startup financial guidance!