Home /Startup/ Company Corporation/ Limited Liability Partnership

Limited Liability Partnership

Limited Liability Partnership for Business

Why Limited Liability Partnership?

1. Works on the full frame of Partnership firms with Limited Liabilities

2. Suitable for traditional and proven model business like consulting , financing , marketing , trading etc.

3. Managing roles can’t be different as partners own the whole responsibility for the business.

2. Suitable for traditional and proven model business like consulting , financing , marketing , trading etc.

3. Managing roles can’t be different as partners own the whole responsibility for the business.

Our Package Includes

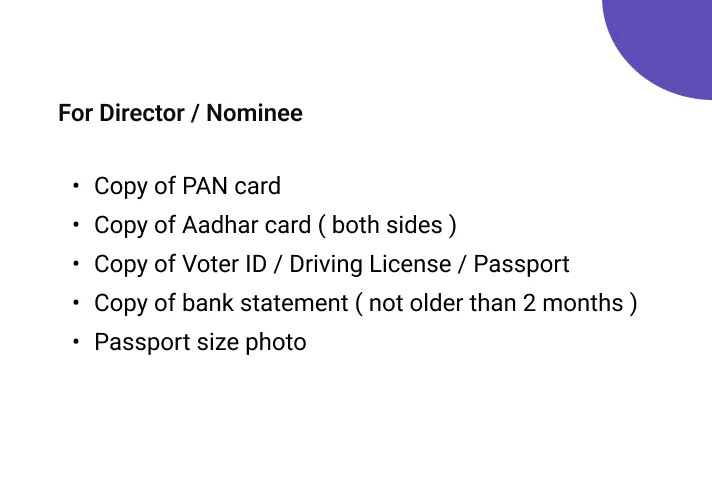

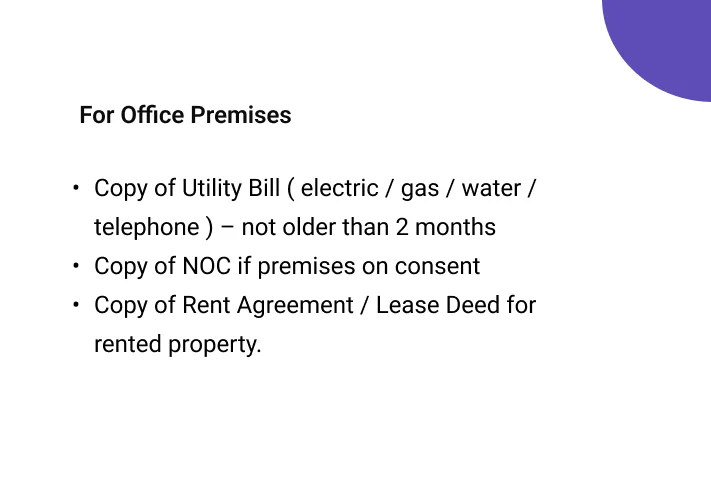

2 Class 3 Digital Signature with 2 years validity.

2 Directors Identification Number ( DIN )

Drafting of LLP Deed

PAN and TAN of the company

GST Registration

Bank Account opening

Udyam Registration

Name Reservation

Stamp Duty as per state – separate charges

Additional Benefits Under Build Better Business Package

Business loan assistance

Startup funding assistance

DIPP Registration / Startup India Recognition

Basic

₹

6999/-

-

LLP Package

-

DIPP Registration

-

Business loan assistance

-

Startup funding assistance

Premium

₹

17999/-

-

LLP Package

-

DIPP Registration

-

Business loan assistance

-

Startup funding assistance

-

Annual compliances for LLP

-

Assistance on MSME Loan

Need Personalized Solution ?

Share your details and our team will reach your will best solutions for your business needs

Our Process

How Coinshell Work

FAQ

Frequently Asked Questions

Physical presence might be needed for specific tasks like identity verification, but many processes can be done online.

Any individual or body corporate can be a partner in an LLP. A partner must be at least 18 years old and mentally sound.

To start an LLP, you need a minimum of two partners. Obtain a Digital Signature Certificate (DSC) for partners, apply for a Designated Partner Identification Number (DPIN), and file incorporation documents with the Registrar of Companies.

A DSC is an electronic signature that ensures the authenticity and security of documents filed electronically, including those required for starting an LLP.

The LLP Agreement is a legally binding document that outlines the rights, duties, and obligations of partners and the rules for operating the LLP.

A minimum of two partners are required to form an LLP. There’s no upper limit on the number of partners.

Start-ups in various sectors, such as consulting, professional services, small-scale trading, and service-oriented businesses, often opt for LLP due to its flexibility and limited liability protection.

LLPs might have slightly lower compliance costs compared to Private Limited Companies. However, the cost difference might not be significant, and the choice should be based on other factors such as long-term goals, scalability, and business structure suitability.

Get a free Consultation

Coinshell delivers the fast assistance over your Business, Accounting , Taxation and Fundraising Needs

Thousands of Startups trust on Coinshell’s theme of Formation to Funding which not only help them start a business but also to raise funds at right time to scale the business