Missed your ROC filings again? The government might just be watching.

Startups are known for their hustle, speed, and flexibility but that same energy often leads to missed compliance deadlines. And in 2024, the Registrar of Companies (ROC) is no longer looking the other way. With stricter digital audits, AI-based triggers, and regulatory pressure, ROC scrutiny has increased like never before.

So, what’s triggering this wave of vigilance? Why is your business more likely to get flagged? And most importantly, how can you avoid falling into the penalty trap? Let’s break it down.

Why is ROC Scrutiny on the Rise?

Over the last few years, the Ministry of Corporate Affairs (MCA) has significantly ramped up its digital monitoring. Here’s why:

1. Push for Transparency & Corporate Governance

With rising corporate frauds, shell companies, and misreported filings, the government is doubling down on transparency. The MCA wants to ensure that every company operating in India is accountable.

2. Tech-Driven Tracking

Gone are the days of manual audits. The ROC now uses automated tools and AI-based systems to flag:

- Mismatched financials between ROC and Income Tax Department.

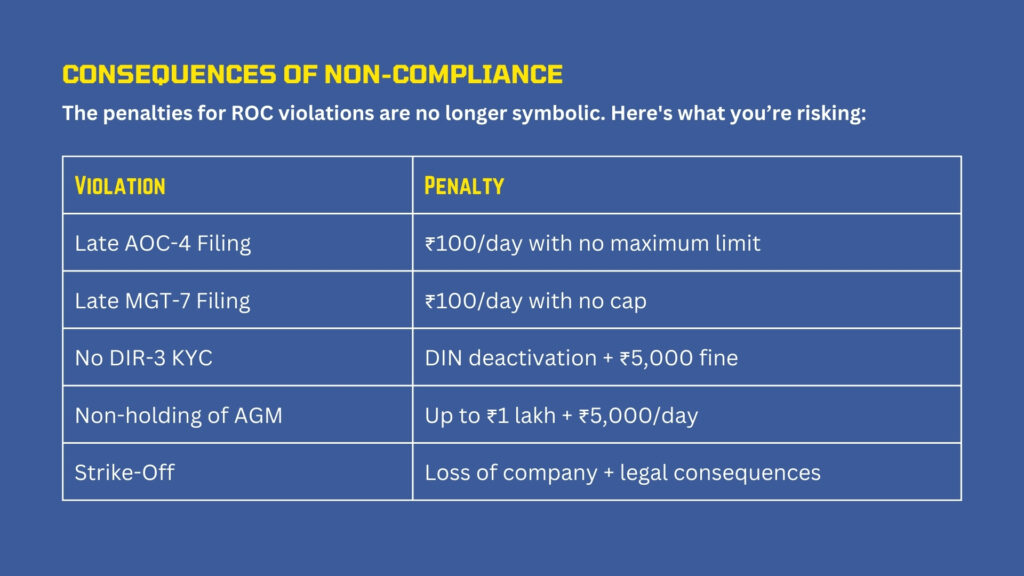

- Late filings of key forms like AOC-4, MGT-7, DIR-3 KYC, etc.

- Dormant or shell-like activity.

3. Strike-Off Drives

Over 2.5 lakh companies have been struck off for non-compliance in the last 5 years. Expect stricter enforcement ahead.

Common Red Flags That Trigger ROC Scrutiny

If you’re a startup or small business, these are signs you may be under the ROC radar:

- Late or skipped annual filings (MGT-7 & AOC-4)

- Non-compliance with DIR-3 KYC (for directors)

- Zero revenue but continued active status

- Irregular share capital updates or director changes

- Non-filing of resolutions for significant decisions

- Not maintaining statutory registers and board minutes

How to Avoid Penalties: Coinshell’s Quick Compliance Guide

- File on Time: Use a compliance calendar or hire an expert to stay ahead of deadlines.

- Maintain Records: Minutes, registers, board resolutions, keep them up-to-date.

- Regular ROC Check-ups: Conduct a compliance health check every 6 months.

- Appoint a Compliance Consultant: Especially if you’re a startup founder with no legal background.

How Coinshell Helps You Stay Compliant?

At Coinshell, we specialize in startup compliance and ROC advisory:

- Annual Filings (AOC-4, MGT-7, DIR-3 KYC)

- Compliance Health Checks

- Board Meeting Documentation & Resolutions

- ROC Queries & Scrutiny Support

With a single partner handling your legal and financial backend, you can focus on growing your business without the fear of ROC penalties.

Final Thought: It’s Better to Be Proactive Than Penalty-Active

The ROC isn’t trying to trouble founders, it’s simply enforcing the law. But for startups used to “move fast and break things,” compliance often becomes an afterthought.

Don’t let a missed form cost you your startup’s credibility or existence.

Let Coinshell be your compliance partner.

Contact us or visit www.coinshell.in to book your free ROC check-up today!