Section 80G and 12A License

Home > IPR & Services > Section 80G and 12A License

12AA and 80G License for NGO

Make your donation worthy for doners

1. 12A and 80G are basically sections under Income Tax to give tax relief to doners in a NGO

2. It creates a trustable pathway for NGO to go for social work CSR funds from Industries.

3. It helps to creates a pathway to go for FCRA license in future for overseas donations.

2. It creates a trustable pathway for NGO to go for social work CSR funds from Industries.

3. It helps to creates a pathway to go for FCRA license in future for overseas donations.

Empowering NGOs, Enriching Lives: Tax Benefits for Change.

1. The fund used for social work or charity is considered to be the use of the funds .

2. The income received will be free from the charge of Income Tax.

3. The person who is registered under Section 12A can avail benefits for accumulating or setting aside income. However, the income which is set aside should not be more than 15% of the amount applied towards charitable or other non-commercial purposes.

4. The accumulation of income which is considered to be the income application shall not be included in the assessee’s total income.

5. NGOs are entitled to receive grants as funds from domestic and international sources. These agencies are entitled to provide grants to NGOs which have obtained registration under this section.

6. The registration which is granted under Section 12A shall be treated as a one-time registration.

7. Once the registration is made, the registration will be active until the date of cancellation.

8. There is no requirement to renew the registration periodically. Hence, the registration benefits can be claimed NGO as and when the requirement arises.

2. The income received will be free from the charge of Income Tax.

3. The person who is registered under Section 12A can avail benefits for accumulating or setting aside income. However, the income which is set aside should not be more than 15% of the amount applied towards charitable or other non-commercial purposes.

4. The accumulation of income which is considered to be the income application shall not be included in the assessee’s total income.

5. NGOs are entitled to receive grants as funds from domestic and international sources. These agencies are entitled to provide grants to NGOs which have obtained registration under this section.

6. The registration which is granted under Section 12A shall be treated as a one-time registration.

7. Once the registration is made, the registration will be active until the date of cancellation.

8. There is no requirement to renew the registration periodically. Hence, the registration benefits can be claimed NGO as and when the requirement arises.

Our Package Include

1. 12 A and 80G certificate

2. NGO Darpan Registration

3. Payment Gateway Setup

4. CSR Funds support activities

2. NGO Darpan Registration

3. Payment Gateway Setup

4. CSR Funds support activities

Help us help you by sharing your details that will enable us to provide you with the best possible assistance.

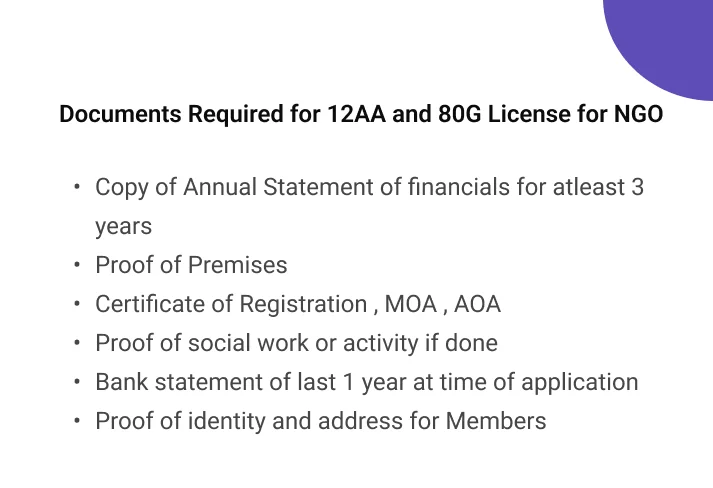

Documents Required for Trademark Registration

Need Personalized Solution ?

Please provide your contact information, and our team will get in touch to offer optimal solutions tailored to your business requirements.

Our Process

Know How Coinshell Work

Step 1

Purchase the plan

Step 2

Share/ Upload the documents

Step 3

Draft of application in 72 hours

Step 4

License in hand in next 7 working days