TDS Return

Home > Taxation > TDS Return

TDS Return for Business

Why TDS Return is Important?

1. Prevents event of tax evasion between two parties.

2. Claiming back refundable amount in taxation cycle for every year is easy.

3. TDS returns builds credibility of business in government records.

2. Claiming back refundable amount in taxation cycle for every year is easy.

3. TDS returns builds credibility of business in government records.

TDS/TCS Return and it’s nature

TDS/TCS return is a quarterly statement to be given to the I-T department. It is compulsory for deductors to submit a TDS/TCS return on time. According to Section234E, if an assessee fails to file his/her TDS Return before the due date, a penalty of Rs 200 per day shall be paid by the assessee until the time the default continues. However, the total penalty should not exceed the TDS amount

TDS Return for individuals and businesses

An employer or company that has valid TAN – Tax Collection and Deduction Account Number can file for online TDS return. Any individual or business who makes a particular payment which is stated under the I-T Act needs to deduct tax at source. The deposit for the same has to be made within the stipulated time. The payment categories include:

TDS Return for individuals and businesses

An employer or company that has valid TAN – Tax Collection and Deduction Account Number can file for online TDS return. Any individual or business who makes a particular payment which is stated under the I-T Act needs to deduct tax at source. The deposit for the same has to be made within the stipulated time. The payment categories include:

Salary

1.Insurance commission

2.Income from winning horse races

3.Income by way of “Income on Securities”

4.Income by way of winning the lottery, puzzles, and others

5.Payment in respect of National Saving Scheme and many others

2.Income from winning horse races

3.Income by way of “Income on Securities”

4.Income by way of winning the lottery, puzzles, and others

5.Payment in respect of National Saving Scheme and many others

Company

1.Persons whose accounts are audited u/s44AB

2.Persons holding an office under the Government

2.Persons holding an office under the Government

Pricing and Plans

Rs.5999/-

YEARLY

1.TDS return Non Salary-26Q

2.TDS return Salary-24Q

2.TDS return Salary-24Q

Unlock Personalized Business Solutions.

Drop Us a Line, and Our Team Will Shape the Ideal Strategy to Meet Your Needs.”

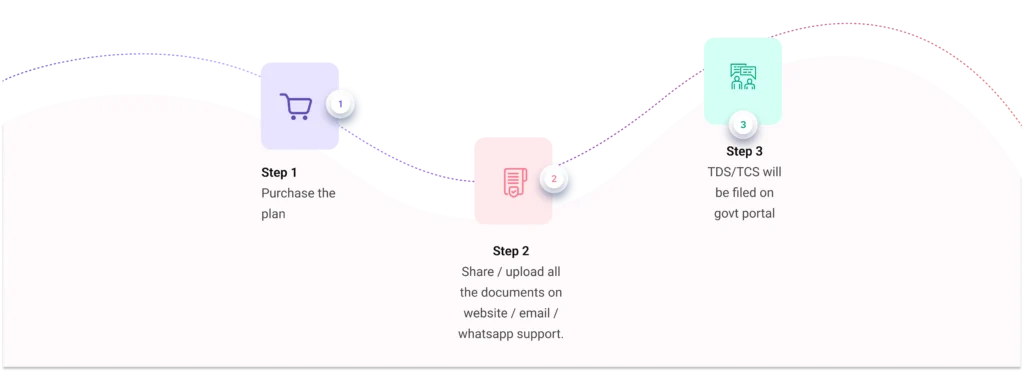

Our Process

Our Seamless Process for Tailored Solutions

FAQ

Frequently Asked Questions

TDS returns need to be filed by entities that have deducted TDS while making payments. This includes employers, businesses, and individuals who make specified payments subject to TDS.

Yes, PAN (Permanent Account Number) is mandatory for both deductors (those deducting TDS) and employees or deductees (those from whom TDS is deducted). It helps in accurate tracking of transactions and tax deductions.

TDS is deposited through designated banks using challans. Online or offline modes can be used for payment, and the payment details are then reflected in the TDS return.

The person deducting TDS is responsible for accurately calculating the applicable tax rate, deducting TDS from payments, issuing TDS certificates, and filing TDS returns within specified due dates.

TAN (Tax Deduction and Collection Account Number) is a unique identification number for deductors. It is mandatory to have a TAN to deduct TDS and file TDS returns.

Yes, PAN is mandatory for deductors as well as employees or deductees. PAN enables proper identification of parties involved in TDS transactions.

TDS can be deposited in authorized banks using TDS challans. Online methods, as well as physically visiting the bank, are options for making TDS deposits.

The TDS justification report provides details of mismatches and discrepancies between TDS deducted and TDS credited in the accounts of deductees. It helps rectify errors before filing TDS returns.

TDS return is generally filed quarterly. The due dates for filing vary depending on the type of deductor and specific quarters.