India is now the third-largest startup ecosystem in the world, trailing only behind the USA and China. With over 90,000 startups registered, this vibrant community is driven by innovation, ambition, and government support through programs like Startup India.

Ever wondered what happens behind the scenes when you make an online payment? Whether you’re ordering food, shopping online, or booking a cab, your money doesn’t go directly to the merchant. Instead, it first passes through a nodal account before being settled into the business’s bank account.

A nodal account is a special-purpose bank account mandated by the Reserve Bank of India (RBI) to facilitate safe and transparent transactions for intermediaries like payment gateways, e-commerce platforms, and online service providers. These accounts ensure that businesses do not misuse customer payments before final settlements.

In this blog, we will break down why nodal accounts are crucial for payment gateways, how they work, and why compliance matters for businesses dealing with online transactions.

What is a Nodal Account?

A nodal account is a non-interest-bearing bank account used by intermediaries such as payment aggregators, e-commerce companies, and ticketing platforms to hold customer payments before transferring them to the final beneficiary.

Unlike regular business accounts, nodal accounts come with strict withdrawal restrictions to prevent fraud, unauthorized fund usage, or mismanagement of customer payments.

Key Features of a Nodal Account:

- Regulated by RBI – Required under RBI’s Payment and Settlement Systems Act, 2007

- Used by Intermediaries – Payment gateways, marketplaces, and aggregators must use nodal accounts for fund processing.

- Restricted Usage – Merchants cannot withdraw funds freely; payments are settled as per RBI guidelines.

- Ensures Transparency – Helps prevent financial fraud and misuse of customer funds.

- Mandatory for Payment Gateways – Every payment processor must operate a nodal account to comply with RBI’s Payment Aggregator Guidelines.

Why Do Payment Gateways Need Nodal Accounts?

Payment gateways like Razorpay, PayU, CCAvenue, and PhonePe rely on nodal accounts to securely collect, hold, and transfer funds between customers and merchants.

Here’s why nodal accounts are essential for payment gateways:

1. Regulatory Compliance & RBI Mandates

- RBI strictly mandates nodal accounts for intermediaries to ensure secure transactions.

- Without a nodal account, payment gateways cannot legally operate in India.

2. Secure & Transparent Fund Flow

- Payment gateways receive funds from customers into the nodal account before transferring them to merchants.

- Ensures no misuse, delay, or mismanagement of customer funds.

3. Fraud Prevention & Customer Protection

- Since payment gateways cannot withdraw funds directly, the system prevents fraud.

- Customers get their refunds processed securely without risk of fund misallocation.

4. Timely Merchant Settlements

- RBI mandates that payment aggregators settle payments to merchants within T+2 or T+3 working days.

- This ensures businesses receive their funds on time without delays or disputes.

5. No Interest Earnings – Prevents Fund Misuse

- Nodal accounts do not generate interest, ensuring payment processors do not misuse merchant funds for investments or lending.

How Does a Nodal Account Work?

Let’s look at a step-by-step breakdown of how a nodal account facilitates online payments:

Step 1: Customer Makes a Payment

A customer places an order on an e-commerce platform and pays via a payment gateway.

Step 2: Payment is Deposited in the Nodal Account

Instead of going directly to the merchant, the money is first held in the nodal account owned by the payment gateway.

Step 3: Verification & Deduction of Fees

The payment gateway verifies the transaction, deducts service charges, and checks for compliance before approval.

Step 4: Final Settlement to Merchant

Once validated, the funds are transferred from the nodal account to the merchant’s bank account within T+2 or T+3 days.

This structured flow ensures smooth digital payments while reducing risks.

Nodal Account vs. Escrow Account: What’s the Difference?

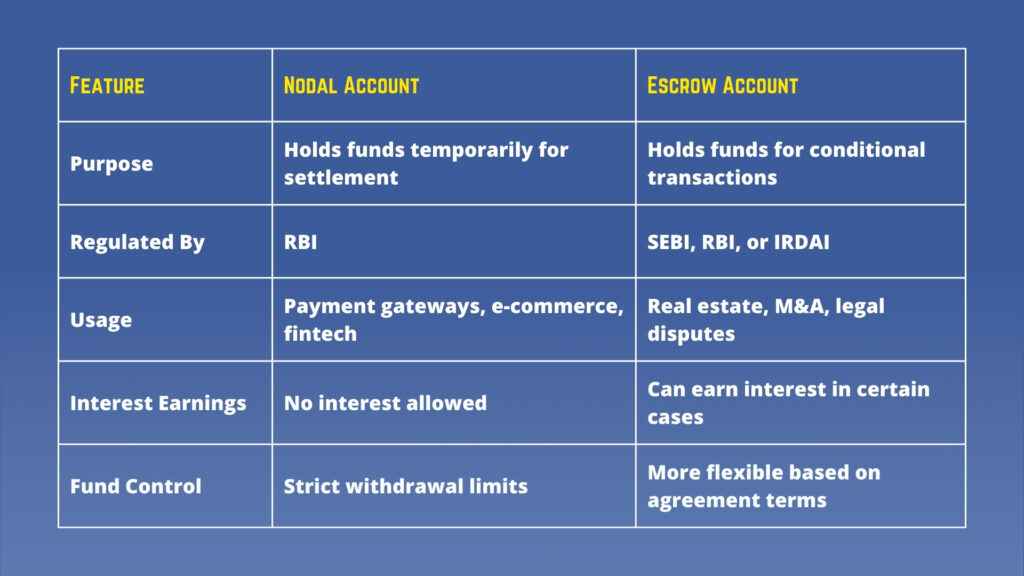

Many confuse Nodal Accounts with Escrow Accounts, but they serve different purposes:

Key Takeaway: If you’re a payment gateway, e-commerce platform, or subscription-based business, a nodal account is mandatory for processing transactions. Escrow accounts, on the other hand, are used for conditional fund holding, often in real estate and M&A deals.

Who Needs a Nodal Account?

A nodal account is essential for businesses that act as financial intermediaries. Some key industries that require nodal accounts include:

- E-commerce Platforms (Amazon, Flipkart, Nykaa, Meesho)

- Payment Gateways & Wallets (Paytm, Razorpay, PhonePe, Google Pay, CCAvenue)

- Ticketing Platforms (BookMyShow, IRCTC, MakeMyTrip)

- Investment Platforms (Zerodha, Groww, Upstox, INDMoney)

- Subscription Services (Netflix, Hotstar, Spotify, Apple Music)

If your business collects and disburses payments, an RBI-compliant nodal account is legally mandatory.

How Coinshell Can Help You Stay Compliant

Setting up a nodal account and ensuring full RBI compliance can be complex. That’s where Coinshell’s expertise comes in!

- End-to-End Compliance Support – Ensuring your nodal account setup meets RBI guidelines.

- Regulatory Filing & Documentation Handling – Hassle-free paperwork management.

- Financial Advisory for Payment Gateway Businesses – Structuring transactions for efficiency and compliance.

- Risk & Fraud Management Solutions – Secure payment processing strategies.

Want to ensure 100% compliance and smooth financial operations? Contact us today!

Why Nodal Accounts Matter?

Nodal accounts aren’t just a regulatory requirement, they are the backbone of India’s digital payment ecosystem. Without them, financial intermediaries cannot legally operate.

For businesses, understanding and setting up a nodal account correctly is crucial for long-term success. If you’re in fintech, e-commerce, or any online service industry, getting the right financial infrastructure in place is key.

Have questions about nodal accounts or compliance? Coinshell is here to help!

Contact us now and ensure your business stays compliant with RBI guidelines.